2026 Illinois Legal Updates Affecting Your Estate Plan

By Long Law Group — Estate Planning and Probate Attorneys Serving Naperville, Chicago, and DuPage County

The new year brings significant legal changes that could affect how Illinois families protect their assets, plan for incapacity, and prepare for end-of-life decisions. Whether you created your estate plan years ago or are just getting started, understanding these updates is essential to ensuring your documents still work the way you intended.

Here are the key 2026 Illinois legal changes every Naperville, DuPage County, and Chicagoland family should know about—and what they mean for your estate plan.

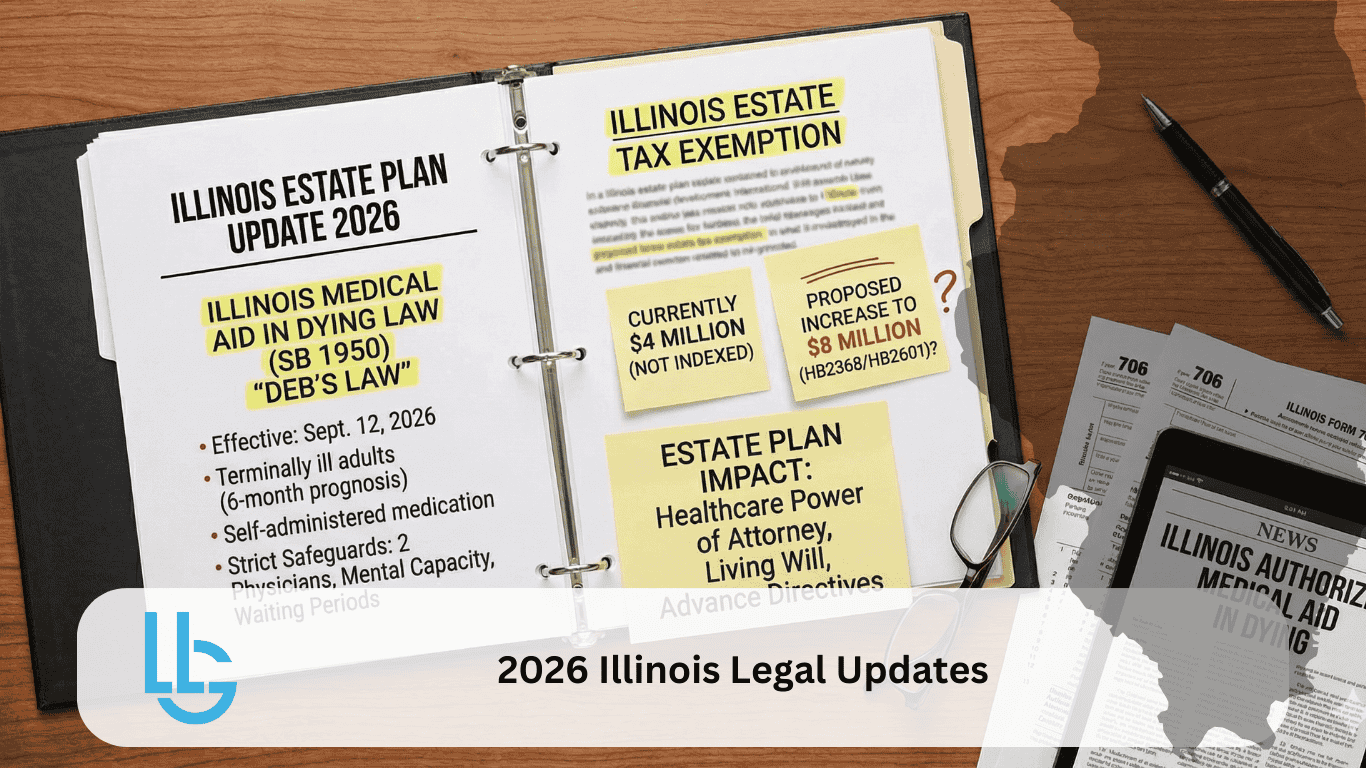

Illinois Medical Aid in Dying Law Takes Effect September 2026

On December 12, 2025, Governor Pritzker signed the End-of-Life Options for Terminally Ill Patients Act (SB 1950), making Illinois the 13th U.S. jurisdiction—and the first in the Midwest—to authorize medical aid in dying. The law, also known as “Deb’s Law,” takes effect on September 12, 2026.

What the Law Allows

Under the new law, Illinois residents who are terminally ill adults with a prognosis of six months or less may request a prescription medication they can self-administer to end their life peacefully. The law includes extensive safeguards to protect patients and prevent abuse.

Key Requirements and Safeguards

- The patient must be an Illinois resident and a legal adult

- Two physicians must confirm the terminal diagnosis and six-month prognosis

- The patient must have the mental capacity to make their own healthcare decisions

- If there is any question about capacity, the patient must be evaluated by a licensed mental health professional

- The patient must make two oral requests and one written request, with a five-day waiting period between the first and second oral requests

- The written request must be witnessed by two individuals

- The patient must be able to self-administer the medication—no one else can administer it

What This Means for Your Estate Plan

While medical aid in dying is separate from traditional estate planning, families facing serious illness should understand how this option fits into the broader picture of end-of-life care. Your healthcare power of attorney, living will, and advance directives remain essential—they address situations where you cannot make decisions for yourself, while the new law applies only when you can actively participate in your own care decisions.

If you or a loved one has been diagnosed with a terminal illness, we recommend discussing all end-of-life options—including hospice, palliative care, and now medical aid in dying—with your healthcare providers and your estate planning attorney.

Illinois Small Estate Affidavit Expansion: Now $150,000

One of the most significant changes for Illinois families came into effect on August 15, 2025, and continues to benefit families in 2026. The Small Estate Affidavit threshold increased from $100,000 to $150,000, and motor vehicles are now excluded from the calculation entirely.

How the New Law Works

- If a loved one passes away with $150,000 or less in personal property (not including vehicles), the estate may qualify for the simplified Small Estate Affidavit process

- Motor vehicles registered with the Illinois Secretary of State can be transferred regardless of value, and they do not count toward the $150,000 limit

- If the estate includes real estate in the decedent’s name alone, formal probate is still required regardless of value

- The law applies to anyone who passed away on or after August 15, 2025

Real-World Example

Consider a Naperville resident who passes away with $140,000 in bank and investment accounts, a car worth $35,000, and personal belongings. Under the old law, this estate would have exceeded the $100,000 threshold and required formal probate. Under the new law, the family can use a Small Estate Affidavit to settle the estate without court involvement—potentially saving thousands of dollars in legal fees and months of waiting.

What This Means for Your Estate Plan

For families with modest estates that don’t include real property, the expanded Small Estate Affidavit may eliminate the need for a revocable living trust solely to avoid probate. However, trusts still offer significant benefits including privacy, incapacity planning, and control over distributions. An experienced estate planning attorney can help you determine which approach makes sense for your situation.

Illinois Power of Attorney Act: Stronger Protections Continue

The Illinois Power of Attorney Act amendments that took effect January 1, 2025 continue to protect Illinois families in 2026. The law now makes it unlawful for third parties—including banks, financial institutions, and healthcare providers—to unreasonably refuse to accept a valid Illinois short-form power of attorney.

Why This Matters

Before this change, many families experienced frustrating situations where banks or other institutions refused to honor properly executed powers of attorney, often demanding their own proprietary forms instead. This left agents unable to pay bills, access accounts, or manage affairs for incapacitated loved ones—sometimes for weeks or months.

Under the amended law, institutions cannot reject a valid Illinois statutory short-form power of attorney simply because it’s “not their form.” While institutions can still request reasonable documentation (such as proof the principal is alive or that the POA hasn’t been revoked), blanket refusals are now prohibited.

What This Means for Your Estate Plan

If your powers of attorney were executed before 2025, we recommend having them reviewed. While older documents remain valid, updating to current forms with attorney certifications can help avoid potential disputes with financial institutions. This is especially important if your named agents have changed, moved, or if your circumstances have evolved.

2026 Estate Tax Thresholds: What Illinois Families Should Know

While Illinois estate tax law hasn’t changed, understanding how it interacts with federal exemptions remains critical for families with significant assets.

Current Thresholds

- Illinois estate tax exemption: $4 million per person

- Federal estate tax exemption: Approximately $13.99 million per person in 2025 (adjusted annually for inflation)

- Illinois does NOT allow portability—meaning a surviving spouse cannot automatically use their deceased spouse’s unused exemption

Why This Matters for Illinois Families

Many Illinois families assume estate taxes aren’t a concern because of the high federal exemption. But the $4 million Illinois threshold captures many middle-class families, especially those with home equity, retirement accounts, and life insurance. A married couple with a combined estate of $8 million could face significant Illinois estate taxes if they don’t plan properly.

Strategies like QTIP trusts, credit shelter trusts, and careful beneficiary planning can help married couples maximize both spouses’ Illinois exemptions and potentially save hundreds of thousands of dollars in state estate taxes.

Digital Assets: An Increasingly Important Part of Your Estate

Each year, more of our financial and personal lives move online. Illinois law recognizes the need for estate planning documents to specifically address digital assets, but many older estate plans don’t include adequate provisions.

Digital Assets to Address in Your Estate Plan

- Online banking and investment accounts

- Cryptocurrency and digital wallets

- Email accounts

- Social media accounts

- Cloud storage (photos, documents, music)

- Domain names and websites

- Digital media libraries

- Business software and subscription services

If your estate planning documents were created more than five years ago, they likely don’t include specific digital asset provisions. We recommend updating your documents to explicitly authorize your executor or trustee to access and manage these accounts.

Your 2026 Estate Planning Action Checklist

Use this checklist to ensure your estate plan is current with Illinois law and your family’s needs:

✅ Review your will and trust documents—do they reflect your current wishes and family situation?

✅ Check your powers of attorney—are your named agents still willing and able to serve?

✅ Verify beneficiary designations on retirement accounts, life insurance, and transfer-on-death accounts

✅ Create or update your digital asset inventory with account information and access instructions

✅ Consider whether the expanded Small Estate Affidavit changes your planning needs

✅ If you have an estate over $4 million, review strategies to minimize Illinois estate tax

✅ Discuss end-of-life care preferences with your family and healthcare providers

✅ Schedule a consultation with an Illinois estate planning attorney if your plan is more than 3-5 years old

Frequently Asked Questions

How often should I review my estate plan?

We recommend reviewing your estate plan every 3-5 years, or immediately after major life changes such as marriage, divorce, birth of a child, death in the family, significant asset changes, or moving to a new state. Legal changes—like those outlined in this article—are also a good trigger for review.

Does the new Medical Aid in Dying law affect my healthcare power of attorney?

No. The Medical Aid in Dying law requires the patient to make their own decision and self-administer the medication. Your healthcare power of attorney addresses situations where you cannot make decisions for yourself. Both documents serve different but complementary purposes in your overall healthcare planning.

If my estate is under $150,000, do I still need an estate plan?

Yes. While the expanded Small Estate Affidavit simplifies asset transfer after death, an estate plan does much more. Powers of attorney protect you during incapacity, healthcare directives ensure your medical wishes are followed, and a will or trust provides clarity for your family and names guardians for minor children. These protections matter regardless of estate size.

What if my powers of attorney are more than 10 years old?

While older powers of attorney remain legally valid, we strongly recommend updating them. The 2025 amendments to the Illinois Power of Attorney Act include new protections, and updated documents with current certifications are less likely to face resistance from financial institutions. Additionally, your named agents’ circumstances may have changed over time.

Start 2026 with Confidence

Legal changes create both opportunities and potential gaps in existing estate plans. The best time to review your documents is before a crisis—not during one. By understanding how 2026 Illinois law affects your estate plan, you can make informed decisions that protect your family and honor your wishes.

At Long Law Group, we help Naperville, DuPage County, and Chicagoland families navigate these changes and create estate plans that actually work when they’re needed most. Whether you need a comprehensive review of existing documents or are creating your first estate plan, we’re here to guide you through every step.

Ready to review your estate plan for 2026?

Contact Long Law Group today to schedule a consultation.

Phone: 312-344-3644

Email: Contact@JLongLaw.com

Proudly serving families throughout Naperville, Warrenville, DuPage County, Cook County, Will County, Kane County, and the greater Chicagoland area.

Additional Articles about Estate Planning and Administration in Illinois

-

- How the Big Beautiful Bill Impacts Illinois Estate Tax Planning

- End-of-the-Year Estate Planning Checklist

- 2025 Legal and Financial Changes Affecting Illinois Estate Plans

- New Year, New Estate Plan Review

- Illinois Small Estate Affidavit Expansion: How to Avoid Probate in 2025

- Estate Planning in Illinois: Will vs Trust – Which Is Right for You?

- Big Changes to Illinois Powers of Attorney – What It Means for Estate Planning

Informational/Promotional Content: The content of this website is informational and/or promotional and not for the purpose of providing legal advice. To obtain legal advice, please contact Long Law Group or your attorney with respect to any particular issue or problem. No Attorney-Client Relationship Created by Use of this Website: Neither your receipt of information from this website nor your use of this website to contact Long Law Group creates an attorney-client relationship between you and Long Law Group or any of its employees. As a matter of policy, Long Law Group does not accept a new client without first investigating for possible conflicts of interest and obtaining a signed engagement letter. Accordingly, you should not use this website to provide confidential information about a legal matter of yours.